How Can Venture Capital Firms Use Sentiment Analysis?

Venture capital (VC) firms invest heavily in innovative technologies and startups that have the potential to make a big impact. As VC firms evaluate potential investments, they need to make sure they’re investing in the right opportunities. Sentiment analysis can help VC firms understand the public sentiment about an investment opportunity, making them better equipped to make an informed decision.

What is Sentiment Analysis?

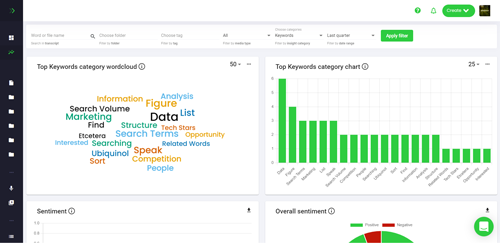

Sentiment analysis is a type of data mining that helps gauge the public opinion of a particular topic. It involves analyzing texts, social media posts, images, videos, and other sources of data to determine the overall public sentiment.

Sentiment analysis can be used to measure public opinion on any topic, including a particular startup, technology, product, or business. By analyzing the sentiment of a particular topic, VC firms can quickly identify trends and patterns. This can provide valuable insights into the potential success of an investment.

How Can VC Firms Use Sentiment Analysis?

VC firms can use sentiment analysis to help them make more informed decisions about potential investments. Here are a few ways in which sentiment analysis can be used:

1. Evaluate the Reputation of a Company

By analyzing the sentiment surrounding a particular company, VC firms can get a better understanding of its reputation. This can include evaluating customer reviews, social media posts, online conversations, and more. This can provide valuable insights into how the public perceives the company, which can help VC firms make more informed investment decisions.

2. Identify Potential Opportunities

Sentiment analysis can also help VC firms identify potential investment opportunities. By analyzing public sentiment on a particular topic, VC firms can identify trends and emerging technologies that may be worth investing in. This can help them stay ahead of the competition and make more profitable investments.

3. Monitor Competitors

Sentiment analysis can also be used to monitor competitors and their investments. By analyzing the sentiment surrounding a competitor’s investments, VC firms can get a better understanding of the success and potential of their investments. This can help them make better-informed decisions and identify potential areas of opportunity.

Conclusion

Sentiment analysis can be a valuable tool for VC firms to make more informed investments. It can help them evaluate the reputation of a company, identify potential opportunities, and monitor their competitors. By leveraging sentiment analysis, VC firms can make more profitable investments and stay ahead of the competition.