How to Transcribe a Recording to Text

How to Transcribe a Recording to Text Our no-code transcription tool enables you to convert an audio recording to text in only two steps. Find

Whether you’re a marketer, a business owner, or someone with an idea for a startup, you need market research. The quickest way to do market research is to buy a comprehensive industry report from a research agency, and this report will contain everything you need to know about the market you’re in or want to enter.

However, ready-made market research reports usually cost tens of thousands of dollars. While they are undoubtedly valuable for any business, not everyone can fork up such a large sum of money.

For most people, conducting market research by themselves is the way to go. However, before you can conduct effective market research, you must know what market research is.

Market research entails gathering information to solve a business or marketing problem. This problem usually involves an organization’s external factors (e.g., competitors, industry) and its marketing 4 Ps (product, price, place, promotion).

Market research is also methodical and systematic, and each step of the marketing research process is planned and well-documented. Moreover, both big and small businesses do market research because information (or the lack of it) affects every part of their operations.

Some benefits that a business can gain from conducting market research include:

Many assume that market research is only conducted after establishing a business and your market offering, and that is not true! You can do market research at any stage of the business development process -- even if you are clueless about the industry, leading competitors, or your potential customers.

This initial market research is called exploratory research. Then, you can do more specific market research such as descriptive research, causal research, competitive analysis, PESTLE analysis... to name a few.

Knowing the differences between market research types is not necessary but learning how to distinguish them will be helpful as you may come across these terms frequently.

Exploratory research: Discovering ideas to help define your business problems for further examination, such as understanding general perception about a competitor.

Descriptive research: Finding out more about specific characteristics of a customer such as their time spent on social media.

Causal research: Testing a cause-effect relationship such as the relationship between customers’ age and preferred retail channel.

Part of doing market research is gathering data. You can do so through primary research and secondary research, and you should use both for effective market research.

Primary research refers to obtaining first-hand data by crafting the questions and interviewing research participants. Since you’re the one conducting the research, you can customize it to fit the specific needs of your research objectives. However, primary research is expensive and more time-consuming than secondary research.

Secondary research is obtaining research data that has already been collected by other people, such as from government agencies. Since you’re skipping the bulk of the research work, secondary research is more affordable and should be used whenever possible. However, data gathered through secondary research may be outdated, uncredible, or not relevant to your business.

Market research is important because it helps you identify potential customers, product ideas and find gaps in your competitors’ offerings. Market research also helps you to understand your customers’ needs and wants -- crucial information if you want to surpass your competitors.

In fact, the most successful companies all rely on market research to improve their products and services. For example, Starbucks ran their famous My Starbucks Idea campaign that led to the revival of their business.

You’ve learned the what and why of market research. Now, it’s time to learn how to do market research. There are 6 main steps in doing market research:

Before you invest your time and resources into starting a business, you should first assess if a market is worth entering. Understanding your market potential is a crucial first step in a market research process. There are several aspects that you should consider when evaluating a market’s attractiveness.

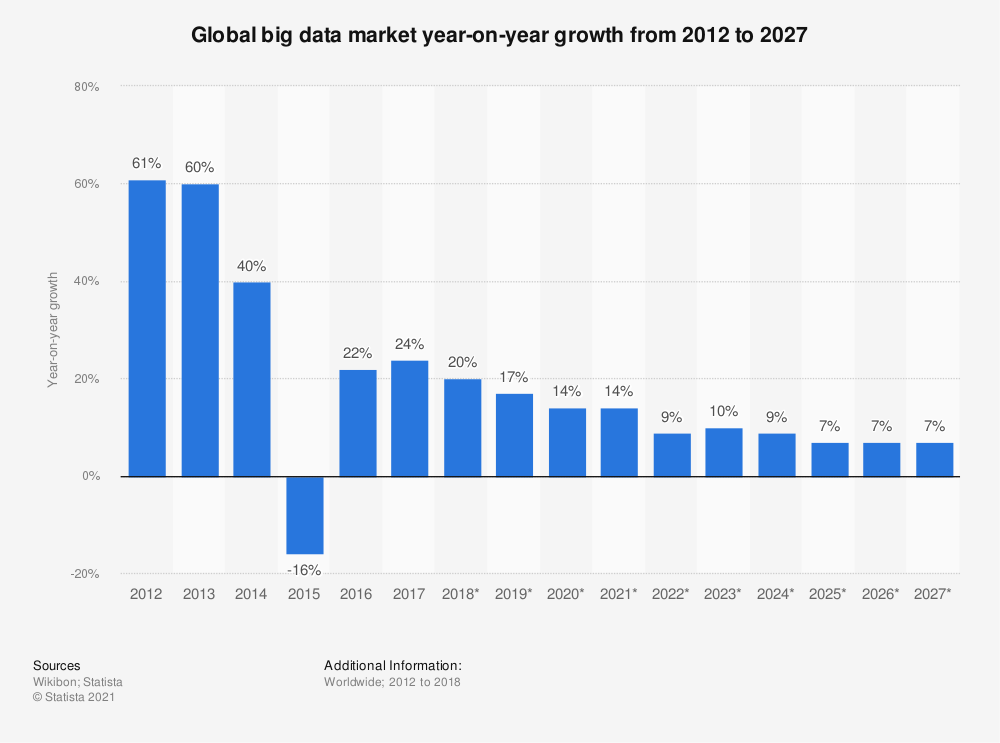

You should determine the market size (total revenue of all companies in the market) and the market’s growth per year (CAGR).

Industries with high CAGR indicate that the demand in that market is growing, which is a positive sign.

You may find reports on market size and growth from Statista, Forrester, BCG, and IBIS World.

A high market growth rate does not mean that entering the market is easy.

Several economic, legal, and technological factors affect the difficulty of entering a market.

These sources include set-up costs, ownership of essential resources, and established competitors with economies of scale.

You should also consider the competitive structure of a market.

For example, a monopoly or oligopoly is more challenging to enter, whereas a monopolistic or pure competition structure is easier to enter.

Part of evaluating a market’s attractiveness involves analyzing its external environment through PESTLE analysis.

In PESTLE analysis, you assess a market’s political, economic, social, technological, and environmental factors.

PESTLE analysis can be quite in-depth, so here is a guideline on what to consider when assessing a market’s external environment.

Another critical aspect of market research is finding the leading players in the industry and why they’re so successful. These competitors can be direct competitors (targeting similar customers with similar market offerings) or indirect competitors (offering different products with the same benefit).

When researching the competitors, it is helpful to organize them into an Excel sheet along with their USPs, brand recognition, products and services offered, and price range.

Identify and list out the largest competitors in a market with Statista and Google. The end goal of market research isn’t just for solving business problems; market research is a tool for outperforming your competitors.

List the largest players in the industry and find out their products, services, and pricing.

At the same time, find their unique selling points (USP) via interviews, online communities, or through their websites.

Knowing this is vital for constructing a differentiation strategy and identifying gaps in their market offering that you can capitalize on.

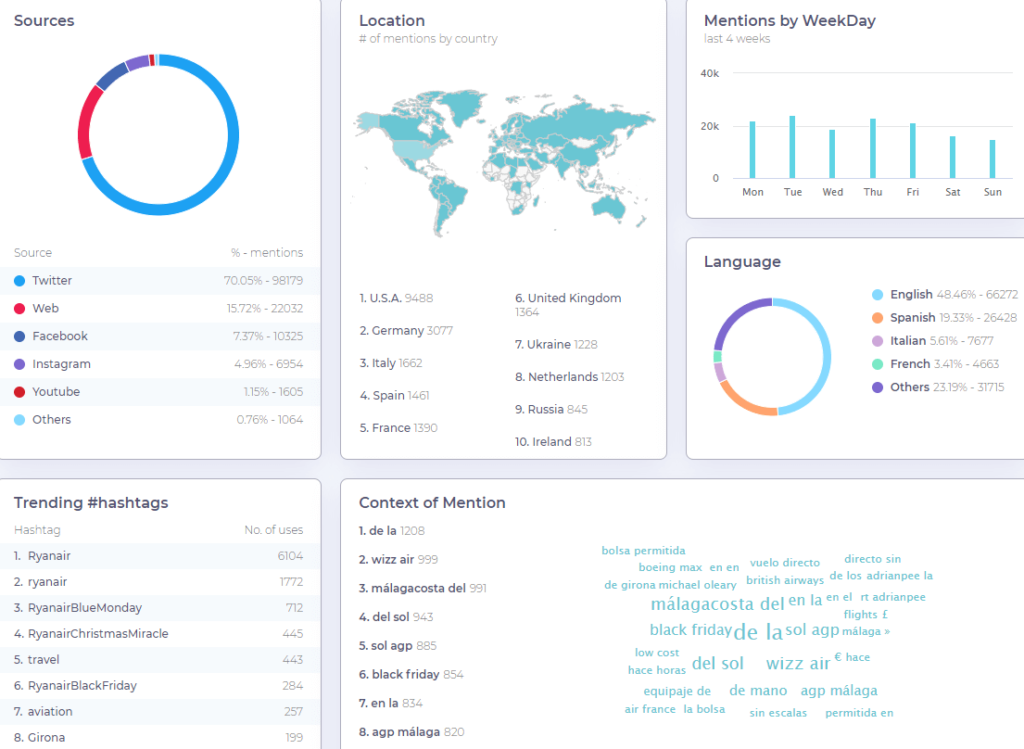

Find out the general sentiment towards your competitors and try to determine their customer loyalty.

You can do so through social listening tools or reading online reviews of their products and services.

For example, reviews on e-commerce websites such as Amazon are a great starting place for consumer products, to find out how customers feel about their competition.

You should assess if your competitors are performing well or regressing financially.

One way to do this is to download their financial reports and monitor changes in revenue.

Moreover, commercial sources such as Statista may provide an overview of the changes in market share between the industry’s main players.

After you’ve gathered information on the market and the competitors inside it, it’s time to find out who the customers in your industry are and what their consumer behavior is.

Generally, you’ll want to research your current and potential customers’ characteristics and pain points.

Once you have a general understanding of who they are, you want to create a buyer persona.

Buyer personas are descriptions of a target customer and represent that entire target audience. This description usually includes their demographics, psychographics, and pain points.

Buyer personas will also be helpful later on for filtering and gathering research participants.

Once you’re done researching your current and potential customers, you may find that your market offering may be sought after by distinct groups of customers.

You should use differentiated marketing strategies to appeal to these customer groups according to their preferences and characteristics.

The demographics of your customers affect your marketing strategy because different customer groups have different needs, wants, and preferences.

Some key characteristics to find out about your customers include:

Psychographics are more intangible characteristics of an individual and include their activities, interests, and opinions (AIOs). Knowing your customers’ psychographics is important because individuals from the same demographic may have different lifestyles, ultimately affecting your marketing strategy.

Besides, it is common for marketers to segment target markets into different psychographics rather than demographics. For example, advertising flower pots for usability versus aesthetics.

Examples of psychographics include:

After identifying the different market segments you may target, you should identify the customers’ pain points and develop solutions. Knowing potential customer pain points will help you create profitable solutions for them and create your own USPs.

There are four main types of customer pain points: financial, productivity, process, and support.

Financial pain points: One key pain point faced by consumers and businesses alike are high expenses. However, you should not confuse cost for value. Customers are increasingly making value-based purchases rather than simply going for the lowest-priced goods.

Productivity pain points: People always want to make the most out of their time and will be more than willing to pay for convenience and efficiency.

Process pain points: Customers may be facing issues in their current processes or may not even realize that their purchasing process is inefficient. For example, Amazon improved the retail purchasing process by providing same-day delivery.

Support pain points: Support pain points are obstacles that customers run into during the purchasing journey and do not receive sufficient help from the business—for example, lack of information about a service.

After researching the market, main competitors and creating buyer personas, use that information to formulate the research questions and gather research participants for primary research.

However, you can’t just interview anyone.

As a general rule, avoid inviting your friends and family as research participants because they may refrain from providing honest feedback out of courtesy. What you need is blunt and brutal feedback that you may get from strangers.

Use the buyer persona you created earlier as a filter for your research participants.

While a large sample size is good, it is a better use of resources to interview relevant people who have first-hand experience with the market’s existing products and services. A good place to start is to invite your existing customers and ask them for feedback.

Regardless of who your research participants are, make sure to provide them with sufficient incentives such as cash, credit, or vouchers. This can help build better relationships with your target audience and improve your brand recognition.

You’ve got your research questions and participants ready and conducted secondary research on the market and your competitors. However, secondary research alone may leave you with gaps in the gathered data. This is where primary research comes in as you conduct face-to-face research with your research participants.

There are several methods that you can use to conduct primary research, the most common being:

As mentioned, you should always document every step of the market research process. The best way to record primary research is to use transcription services. Transcription services in market research involve audio or video recording a research session and converting the recording into written texts.

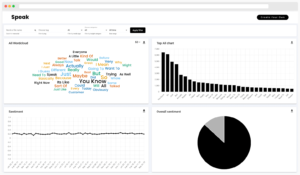

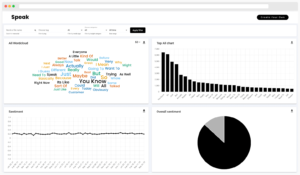

Our transcripts are interactive and stitched to the audio, making it easy to search for specific moments. Speak also comes with text and sentiment analysis tools to help you identify trends and patterns in what your research participants say, allowing you to gain more insights and patterns to develop your final strategy around.

Want to know how our transcription services can increase your market research ROI? Try 7-days of premium access to Speak with no credit card required.

You will likely have an overwhelming amount of data and insights at the end of your market research.

Since you conducted the research, it’s easier to make sense of all that collected data.

However, that may not be the case with your colleagues or your supervisors.

You must summarize your research findings and present a well-structured research report to them. Your research report should also conclude with an action plan -- why you began market research in the first place.

If you’ve never created a market research report before, here’s a simple guideline that you can follow.

Executive summary: Summary of the entire market research, including the action plan.

Research objectives: Why did you set out to obtain the gathered information, and what business problem does it solve?

Processes followed: Your methods for data collection and analysis.

Results: What did you find out after collecting the data.

Appendix: Using software like Speak, you can create a shareable media and transcript library that can easily be shared with teammates and management.

Conclusion and recommended steps: The following steps your organization should take based on your research results.

Market research involves gathering information to inform decision-making and solve a marketing problem. This problem can stem from any of the 4 Marketing Ps (product, price, place, promotion) or simply to know more about an industry.

Since market research applies to a broad range of topics, specific research questions may differ depending on the research objectives. However, general market research involves investigating assessing market attractiveness, competition analysis, and market segmentation.

With this information in hand, you can then make more effective decisions and take your business to the next level.

Get a 7-day fully-featured trial.

How to Transcribe a Recording to Text Our no-code transcription tool enables you to convert an audio recording to text in only two steps. Find

How to Transcribe a YouTube Video You don’t need to convert a YouTube video into mp4 to transcribe it. Simply upload the URL to Speak

How to Transcribe Audio and Video to Text in 2 Minutes (2022 Guide) Learn how to transcribe audio and video to text with Speak Ai

The Complete Guide to Text Analytics (2022) Text analytics (or text mining) refers to using natural language processing techniques to extract key insights from chunks

What is Natural Language Processing: The Definitive Guide Natural language processing is the large field of studying how computers can understand human language accurately, and

All About Sentiment Analysis: The Ultimate Guide You may have heard of sentiment analysis before, but what exactly is it, and why are organizations so

Powered by Speak Ai Inc. Made in Canada with

Use Speak's powerful AI to transcribe, analyze, automate and produce incredible insights for you and your team.