Speak Ai vs Scribie - A more useful Scribie alternative

Speak Ai is an automated transcription alternative to Rev that provides you with searchable audio, video and text to make your information more accessible.

Looking for the best alternative to automated transcription and analysis software?

Understand how Speak Ai compares to our competitors so you can find the best fit for your needs

Searching for the right transcription and analysis tool shouldn't be a complicated processes.

That's why we've distilled key information about how we outperform or differentiate ourselves from other products in the space.

On this page you can find a high-level overview and comparison of main features, pricing structures and in-depth profiles of Speak vs Speak alternatives.

If you're feeling adventurous, give Speak a try for free to see how we're building a platform for insightful analysis of both professional and personal content.

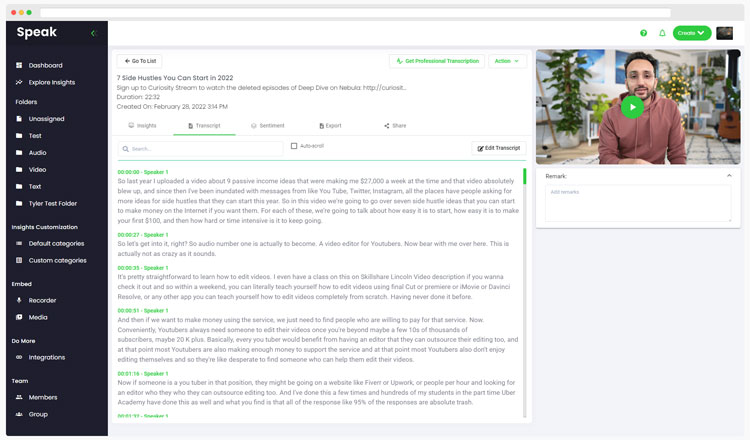

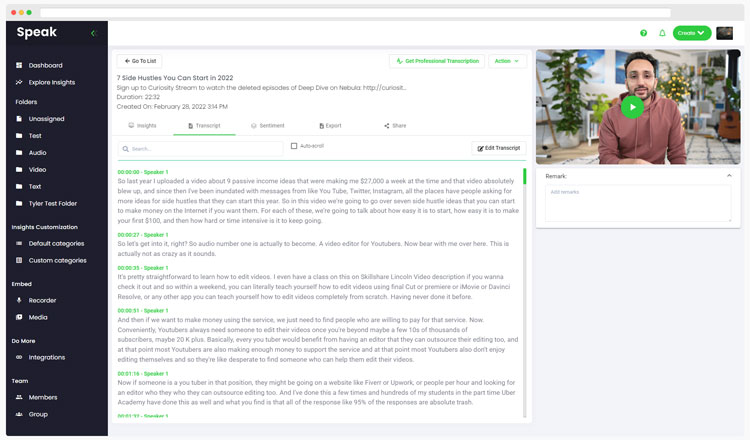

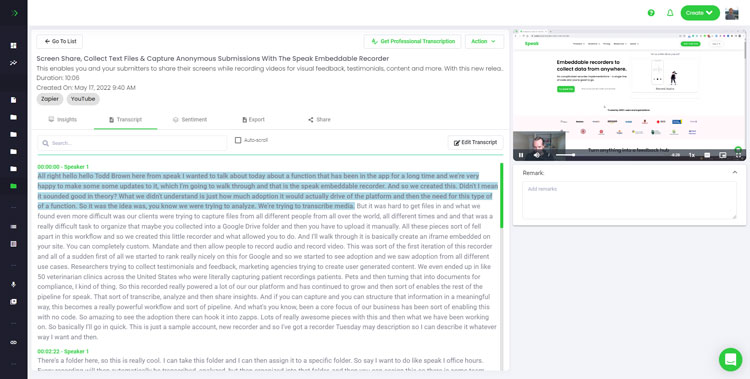

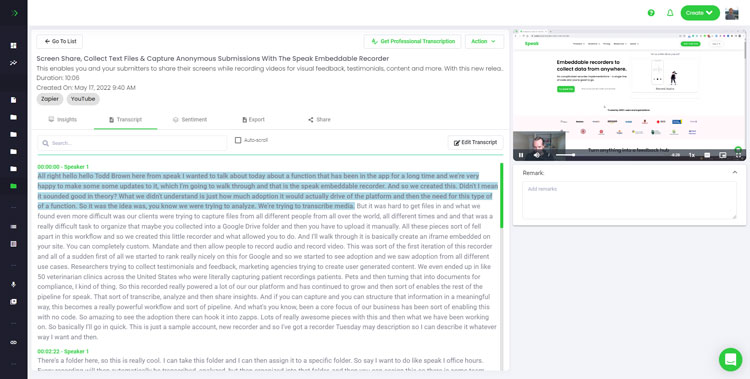

Use AI, intelligent search and data visualization to unlock meaningful insights from audio, video & text.

Get a 7-day fully-featured trial.

We want to make sure you get to test out the platform before you sign up for a plan.

That's why we give you access to all our premium features and 30 free minutes of transcription and analysis in a 7-day trial.

For enterprise solutions or questions about our pricing, please get in touch with our team at success@speakai.co.

While we offer automatic transcription with a high accuracy rate, the best way to ensure 99.9% accuracy is to have humans and our software work together to make that happen.

Our team of exceptional transcribers makes sure that your automatically generated transcripts are reviewed, edited and presented with that human touch.

Once that's done, we encourage you to use Speak to analyze your interview content and unlock the true power of our platform to help you gain useful insights.

Privacy is our number one priority. All our services are HIPAA compliant, which means that we only use the minimum amount of personally identifiable information required to make sure our system work.

Our transcription team is also fully HIPAA trained and we take multiple steps to make sure that anything you upload is stored safely.

You can use Speak for everything from sensitive research to personal analysis and marketing.

We have clients from various industries who use Speak to further their business goals but also take advantage of our platform to brainstorm, analyze speech habits, find trends in their content strategy or to conduct competitor research.

Feel free to visit our resources section to explore the power of Speak.

Check out our free text analysis tools that you can visit to instantly generate word clouds, do named-entity recognition and run sentiment analysis.

Get a 7-day fully-featured trial.

Detailed Comparisons

We've compiled a list of detailed comparisons of other platforms and why people end up switching to Speak Ai for their needs

Speak Ai is an automated transcription alternative to Rev that provides you with searchable audio, video and text to make your information more accessible.

Speak Ai is an automated transcription alternative to Rev that provides you with searchable audio, video and text to make your information more accessible.

Speak Ai vs Happy Scribe Speak Ai is a Happy Scribe alternative that analyzes your data for you. Use Speak to get crucial insights, sentiment

Speak Ai vs Phonic Ai Speak is a video research software alternative to Phonic Ai offering embeddable recorders, white labeling and a way to easily

Speak Ai vs Dovetail Speak Ai is a great research repository alternative to Dovetail that offers white labeled solutions, professional transcription and an available API.

Speak Ai vs Fireflies.ai Speak Ai is a great automated transcription alternative to Fireflies.ai with a workflow built for bulk transcription, management of text data

Aggregate data from multiple sources and gain useful competitor & customer insights using a holistic text analysis experience using Speak Ai.

Speak Ai allows you to augment your content creation process by doing more than just transcription.

Speak Ai is an automated transcription alternative to Rev that provides you with searchable audio, video and text to make your information more accessible.

Get a 7-day fully-featured trial.

Powered by Speak Ai Inc. Made in Canada with

Use Speak's powerful AI to transcribe, analyze, automate and produce incredible insights for you and your team.